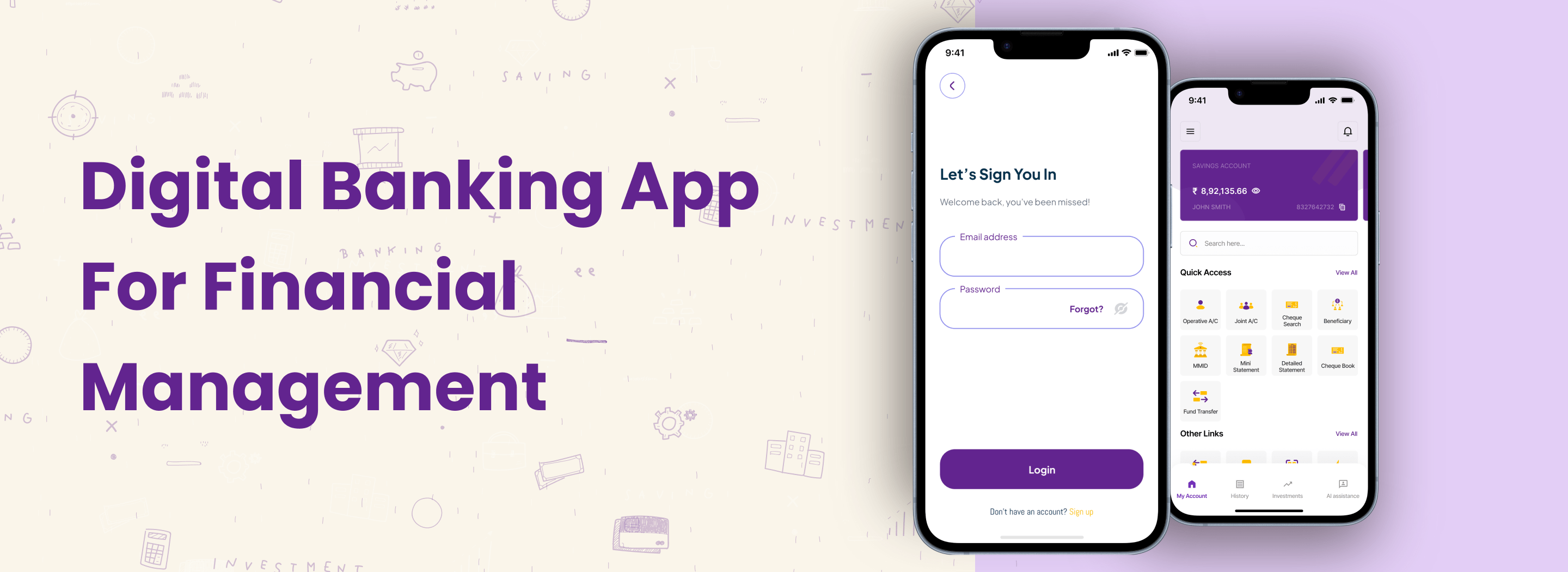

Digital Banking App For Financial Management

About Client

Industry

Fintech

Location

USA

Project Overview

To address these challenges, Sculptsoft developed an advanced Digital Banking Application that caters to users’ diverse financial needs. This solution streamlines core banking operations, enhances accessibility, and ensures a seamless digital banking experience.

Traditional Process

01

02

03

04

05

Manual Fund Transfer Requests: Fund transfers required customers to fill out physical forms at the branch. The approval and processing of these transfers took time, often delaying transactions.

06

07

Challenges Faced

01

02

03

04

05

06

07

08

09

10

11

Our Solutions - Digital Banking App For Financial Management

01

02

03

04

05

06

07

08

09

10

11

12

13

Outcome

85% of users reported greater satisfaction due to the app’s ease of use and fast access to services, improving retention.

Customers no longer needed to visit physical branches for routine tasks, with 75% opting for digital solutions, saving time and reducing foot traffic.

Manual errors reduced by 60% , enhancing account management, fund transfers, and cheque services.

Real-time updates were available to 95% of users, fostering increased trust and ensuring accurate financial activities.

80% of customers began using mobile banking features like utility bill payments, FD & RD management, and cheque book requests, driving digital engagement.

98% of users reported higher confidence in digital banking due to biometric authentication and OTP verification.

Features

Account Overview

AI Chatbot Assistance

Operative & Joint Accounts

Mini & Detailed Statements

Cheque Services

Beneficiary Management

Fund Transfer

Fixed Deposit (FD) & Recurring Deposit (RD)

Loan & ATM Card Requests

Bill Payments

Notifications

Branch Details

Technology Stack

Front-end

- iOS

-Swift

-MVVM Architecture

-Core Data

-Alamofire - Android

-Kotlin

-Java

-MVVM Architecture

-Jetpack Compose

-Room

-Retrofit - Material Design

- Shimmer

- Lottie

DevOps & Server

- Jenkins CI/CD

- AWS

Financial Features

- JasperReports or BIRT

- Stripe API or Razorpay

- SWIFT API

Notifications

- Firebase Cloud Messaging (FCM)

- Email/SMS: Twilio or SendGrid

Security

- OAuth2 and JWT

- Data Masking and Encryption

Testing

- Unit Testing: JUnit 5 (Android)XCTest (iOS)

- UI Testing: Espresso (Android), XCUITest (iOS)

- Performance Testing: Android Profiler (Android), Xcode Instruments (iOS)

- Mockito

- Postman or Swagger UI

Crash Reporting

- Firebase Crashlytics

- Sentry